Nonprofit Case Study: Audit-Ready GAAP Financials in Excel

In most Nonprofits, the annual financial audit is like the next Taylor Swift album—some look forward to it, others dread it, but either way, it’s coming. For finance leaders, it’s more than a recurring task: it’s about ensuring accurate reporting, building trust with constituents, and strengthening financial management.

Now picture yourself as a Nonprofit CFO today. Costs are rising, funding is more competitive, talent is scarce, and deadlines never seem to ease. The faster you deliver audit-ready financials, the faster you can refocus on sustainability and mission impact.

That’s where GAAP-compliant reporting comes in. It ensures accuracy, transparency, and compliance, boosts constituent confidence, and provides a solid base for budgeting, forecasting, and long-term planning. In today’s climate, producing audit-ready GAAP financials isn’t just best practice—it can be the difference between thriving and struggling.

Why GAAP Financial Statements Matter for Nonprofits

GAAP financial statements are standardized reports prepared in accordance with Generally Accepted Accounting Principles. They provide a consistent and credible way of presenting a nonprofit’s financial position, results of operations, and changes in net assets.

Here are some of the key pillars of GAAP financial statements for Nonprofit organizations:

- Consistency & Comparability

– GAAP establishes a common framework for financial reporting.

– This consistency makes it possible to compare a nonprofit’s financial performance across different years, and for stakeholders to compare the organization with peer nonprofits. - Transparency & Credibility

– GAAP requires clear presentation of revenues, expenses, assets, liabilities, and net assets.

– Following these standards gives external stakeholders confidence that the numbers are reliable, enhancing trust with donors, grant makers, and regulators. - Clear Picture of Restrictions & Mission Impact

– Nonprofits often receive funds that are restricted for specific uses. GAAP requires reporting net assets with donor restrictions and net assets without donor restrictions separately.

– This helps boards and funders see not just how much money the nonprofit has, but how much is actually available for general operations versus earmarked for special programs. - Compliance with Legal & Funding Requirements

– Many funders, banks, and government agencies require GAAP-compliant financial statements, often in audited form.

– Without GAAP reporting, a nonprofit may not be eligible for certain grants, contracts, or financing. - Better Decision-Making for Leadership & the Board

– GAAP financials provide a comprehensive view of financial health, including sustainability, liquidity, and capacity for growth.

– With reliable data, nonprofit leaders and boards can make informed, strategic decisions instead of relying on incomplete or informal internal reports.

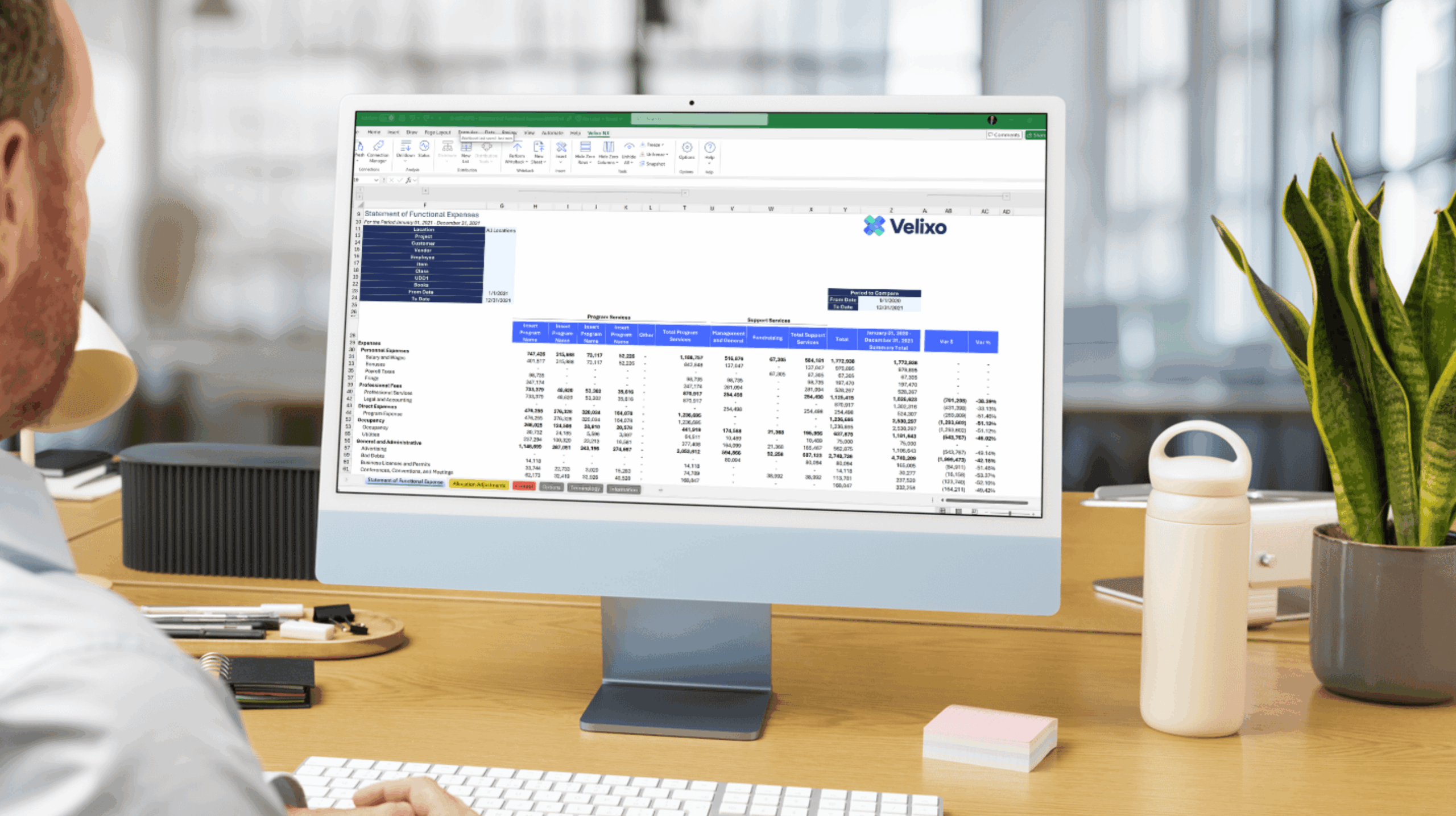

The Critical Role of Excel and Velixo in Audit-Ready Financials for Nonprofits

Excel is the most commonly used tool in Nonprofit for several compelling reasons, ranging from its versatility to its widespread adoption. Velixo adds deep ERP integrations that facilitate interacting with live ERP data right from Excel. Coupled together, Excel and Velixo offer a self-service, rich analysis and real-time solution that reflect Nonprofit organizations’ missions.

Here’s why Excel and Velixo hold a significant place in empowering Nonprofits:

- Familiarity and versatility: As the industry standard, Excel has long been central to nonprofit reporting. Its intuitive interface and widespread use mean most staff—from program managers to CFOs—can work in it with little training. Beyond ease of use, its flexibility supports everything from budgeting and grant management to GAAP financials and allocations.

- Customizability: Nonprofits often need reports beyond standard ERP outputs. Excel’s flexibility, combined with Velixo’s cell- and function-based design, lets users create tailored calculations and reports that match how their organization works—critical in a sector where no two nonprofits are alike.

- Ability to report across books and ledgers: Nonprofits often need to combine data from multiple books or ledgers. For GAAP financial statements, reporting typically comes from the main (Accrual) book, with the option to include additional books as needed. Velixo’s functions and query features make cross-book and cross-ledger reporting straightforward, even for complex scenarios.

- Live, bi-directional Excel integration: Velixo connects Excel directly to your Sage Intacct data, so reports update in real time – and you can push changes like budgets, allocations, and journal entries directly from Excel into your ERP.

- Accurate information: Access to the most up-to-date data is critical for Nonprofit organizations. With Velixo, real-time data is extracted from the ERP meaning there’s no manual data exports, and data is always correct with no lags.

- Nonprofit template package: The Velixo for Sage Intacct Nonprofit templates come with built-in controls, terminology mapping, dimension validation, and pre-configured logic for fund accounting, net asset classification, and audit readiness. They are designed for nonprofit structures – without requiring technical setup or external data models.

- Freezing data: Nonprofit organizations may not grant access for all team members to the ERP. With Velixo’s Snapshot feature, “frozen” reports can be shared with users even if they do not have ERP logins.

Conclusion

In the world of Nonprofit, where the next set of eyes on your financial statements could belong to someone making a monumental funding decision, the ability to produce audit-ready GAAP Financial Statements is invaluable. Velixo for Sage Intacct Nonprofit’s financial reporting templates are designed to give Nonprofit accounting and finance leaders the tools they need to report the way their organization needs it and keep their focus on the mission.